Heloc low credit score

A HELOC has low interest rates but it requires you to use your home as collateral. About home equity lines of credit.

Bvalentinerealestate04 Posted To Instagram Owning A Home Comes With All Kinds Of Perks Like Getting A Loan To Help With Upgrade Heloc Home Equity Get A Loan

Higher scores may provide access to.

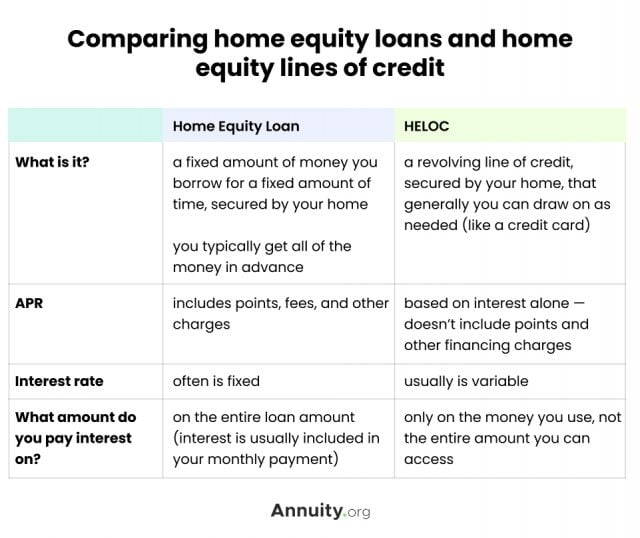

. You should have at least 15 20 home equity. A credit score above 700 is considered ideal. The higher your credit score the lower the fixed rate you will be offered on a home equity loan and the lower the initial rate on a HELOC.

For instance if you have a HELOC for 10000 and close the account after it is paid off that means the 10000 of available credit is no longer being factored into your credit score. If you have good or excellent credit you could lock in a lower HELOC rate closer to 3 to 5. The lower your DTI the better.

6 No or low closing cost for new HELOC loan only. Check Your Rate Learn more. To qualify for a HELOC youll need to have more than 15 20 equity in your home at its current appraisal value.

There could be a temporary drop in your credit score if you enroll in a debt consolidation program but as long as you make on-time payments your score quickly improves and you are eliminating the debt that got you in trouble to start. Anything above 750 is generally considered an excellent credit score. Having good credit can also qualify you for a better interest rate.

A score of 620 or lower will make it hard to secure a home equity loan or HELOC says Theresa Williams-Barrett of Affinity Federal Credit Union. But if you take out a HELOC and. How credit scores are.

15000 to 750000 up to 1 million for properties in California. A HELOC can also affect your credit scorepositively or negativelydepending on how you manage the account. From there credit scores are considered good 700 to 749 fair 650 to 699 or poor lower than 650.

If you have a credit score below 700 you can take steps to improve your credit score before you apply for a home equity line or HELOC. If you have below average credit expect to pay rates closer to 9 to 10. Qualifying amount of equity in your home.

HELOCs depend greatly on credit scores and are most available to people with FICO scores above 720. 1 Wireless carrier text andor data charges may apply. Your score could benefit if you make timely payments and keep the amount you borrow from your HELOC relatively low but falling behind on your payments could mean bad news for your credit score and overall financial health.

A low debt-to-income ratio DTI. Get a start on your project with a Mission Fed Home Equity Line of Credit HELOC HELOC San Diego rates as low as 599 Intro Fixed Annual Percentage Rate APR For the first 12 months. Consider a Debt Consolidation Plan.

Appraisal fee and title insurance if required is an additional charge. To get approved for a HELOC your credit score should fall in the mid-to-high 600sthough a score of 700 or higher is even better. In 2012 they had the mortgage and HELOC No.

Similarly if you have a lower credit score they might only allow you to use 75 percent of your total home equity rather than the 90 percent they might allow someone with strong credit. There also is a one time 50 fee due at closing for refinancing an existing Summit Credit Union HELOCs. According to credit bureau Experian the minimum FICO score for a HELOC is 680.

You will also need a good credit history credit score of 620 or higher and a debt-to-income DTI ratio in the low 40s or lower. Citizens offers GoalBuilder TM Home Equity Lines of Credit as low as 5000 and up to 25000. As the borrower repays the balance on the line the borrower may.

Lender APR Introductory APR Line Amount Range HELOC Terms Max LTV. 2 Guaranteed Rate Inc. It usually takes a very good credit score to qualify for one of these.

A Home Equity Line of Credit HELOC is a flexible line of credit that uses your home equity to access up to 500000 at great low rates. Your approval is based on your credit score credit history the amount of equity you currently have in your home and your debt-to-income ratio also. Does a HELOC affect your credit score.

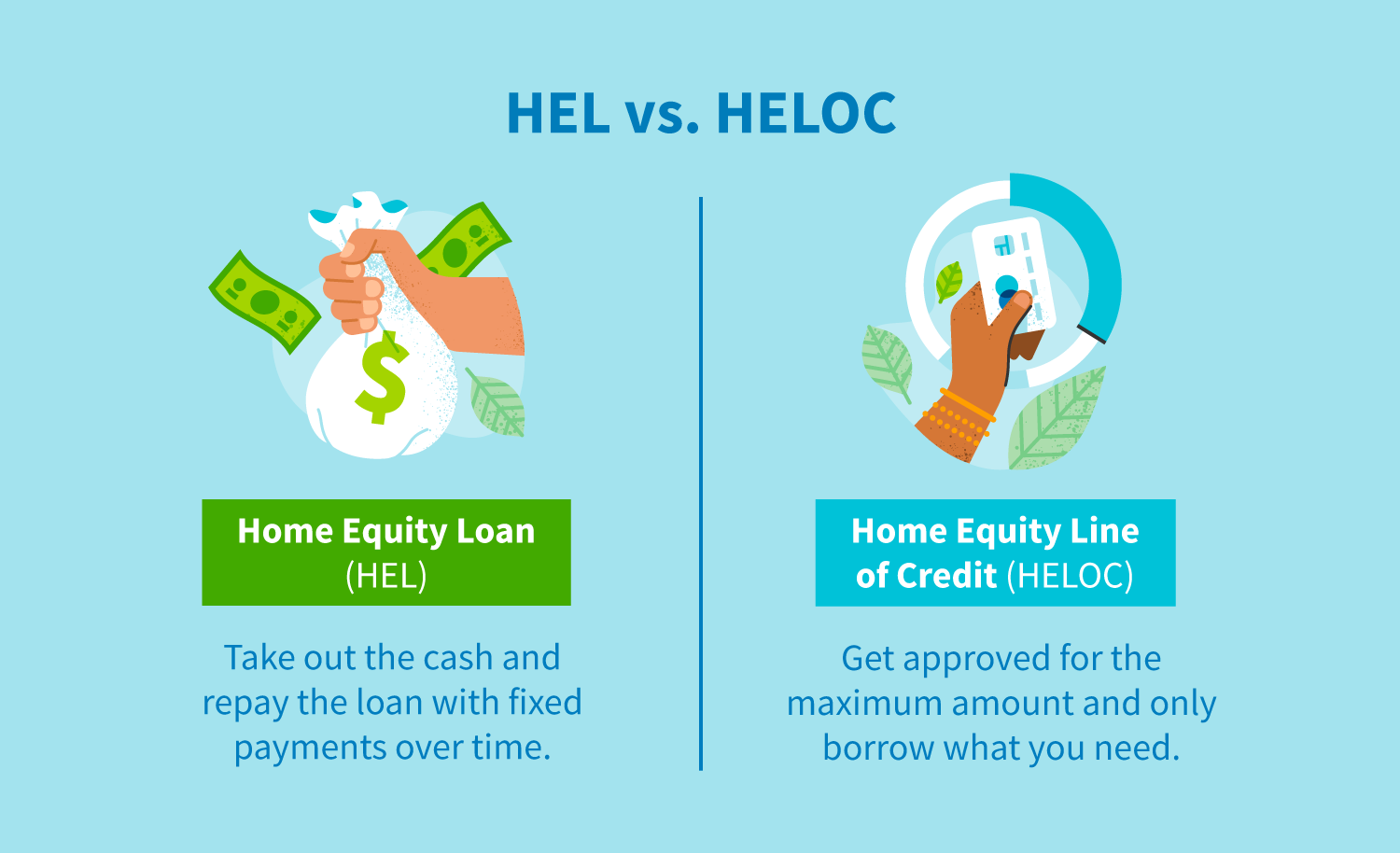

In both instances your credit score will impact the interest rate. Home equity loans usually arent the answer if you only need a small infusion of cash. Though some lenders will extend loans for 10000 many wont give you one for less than 35000.

In order to qualify for a home equity line of credit lenders will usually want you to have a credit score over 620 a debt-to-income ratio below 40 and equity of at least 15. Applying for a HELOC like applying for any type of credit causes a small dent in your credit score since lenders are making inquiries about your credit profile. 1given some payments on the mortgage the outstanding balance is now 150000but their house is now worth 300000 allowing them to take out.

A home equity line of credit or HELOC is a special type of home equity loan. Lenders may evaluate your previous payment history to make sure you havent made any late payments in the past. The charge for an appraisal is typically 430-585 the charge for title insurance is typically 375.

Home equity line of credit HELOC is an open-end product where the full loan amount minus the origination fee will be 100 drawn at the time of origination. HELOCs arent interest-only forever 5 min read. The initial amount funded at origination will be based on a fixed rate.

However this product contains an additional draw feature.

How To Get A Home Equity Loan With Bad Credit Creditrepair Com

Home Equity Line Of Credit Heloc Rocket Mortgage

Heloc Infographic Heloc Commerce Bank Mortgage Advice

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

How A Home Equity Line Of Credit Heloc Can Affect Your Credit Score Liberty Bay Credit Union

Park Bank Home Equity Ads On Behance Home Equity Equity Line Of Credit

Home Equity Line Of Credit Hickam Federal Credit Union

Heloc Loan What Is A Home Equity Line Of Credit

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Home Equity Loan Or Line Of Credit Which Is Right For You Dupaco

Find Your Home S Silver Lining With A Home Equity Line Of Credit Heloc As Low As 2 99 Apr Introductory Fixed Rate For 12 Home Equity Line Of Credit Heloc

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Homeowners Are Sitting On A Record 6 Trillion In Equity Why Aren T They Using It Home Equity Equity Line Of Credit

Home Equity Line Of Credit Heloc Rocket Mortgage

Can You Get A Heloc With A Bad Credit Score Credello